The 75th Edition of the Cannes Film Festival will roll out its red carpet on May 17th. For 10 days, the most prestigious film festival will welcome some of the world’s most famous and talented actors and Cannes will take center stage for cinema enthusiasts, movie buffs and the film industry alike.

The Data Appeal Company, with the support of our partner PredictHQ, went behind the scenes of this highly anticipated event to measure its territorial impact and uncover the hidden gems of this notorious tourism destination through the lense of location intelligence.

How does the festival impact accommodation prices and occupancy? What are the most popular restaurants? Which shops along the Riviera are most in demand? Which days are busiest and what are the peak times at local bars and clubs? Which neighborhoods are most sought after?

Our datasets and proprietary KPIs allow us to answer these and many other questions about Cannes and any other destination in the world.

The Spotlight is on Cannes

It goes without saying that The Cannes Film Festival is an invaluable opportunity for local tourism along the Côte d’Azur.

PredictHQ, our longtime partner and one of the top global event analysts, estimates that over 40,000 people are expected in Cannes in mid-May… just for the Film Festival alone.

“The entire spotlight will be on this event,” comments PredictHQ, “which is why no other events will be held on the same days in Cannes, excluding a few, small concerts.”

However, the Cannes Film Festival is just the tip of the iceberg for French summer tourism. In fact, the event that brings the most tourists to Cannes is not the Film Festival, but the Cannes Yachting Festival, which will be held from September 6th to 11th and expects to welcome over 54,000 visitors.

The Catalyst of French Tourism

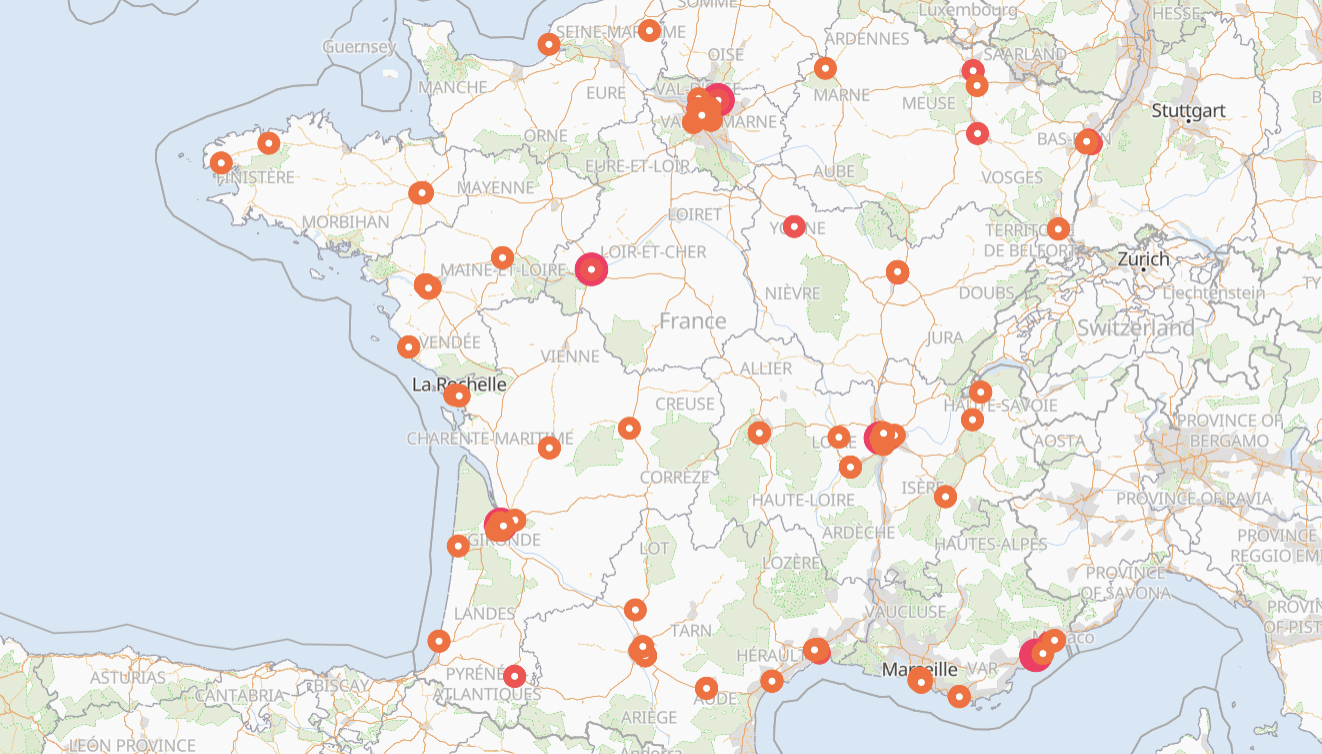

In fact, across France, there are more than 3,670 events taking place over the two weeks of the Cannes Film Festival, 467 of which have more than 500 attendees. Of these, the Cannes Film Festival is not even among the top five events.

The largest include:

- Fair of Tours in Tours, France with 370,000+ attendees

- Foire Internationale de Bordeaux in Bordeaux with 190,000+ attendees

- Nuits Sonores Festival in Auvergne-Rhône-Alpes with 140,000 expected attendees

- Indochine: AR Bus Bullet Concert on May 21 in Saint-Denis with 81,000 attendees

- Rockin’ 100 in Saint-Denis with 81,000 attendees

- Industrie Paris 2022, in Paris with 45,000 attendees

(Information Source: PredictHQ)

Needless to say, after the past two years of strict Covid-related restrictions, these events will be much welcome for tourism operators.

A Red-Carpet Territory Analysis: Hotel prices skyrocket to accommodate 40,000+ expected attendees

After evaluating the City of Cannes with D / AI Destinations, our in-house territory analysis platform, we detected a major surge in both prices and occupancy that’s directly related to the dates of the Film Festival from May 17th to 28th.

On May 19th, the average rate at accommodation properties in Cannes is expected to hit €508 and the saturation from OTA portals is estimated at 71.9% (the ratio between available rooms to rooms sold).

The spike continues as average fares continue to rise through May 20th at €526/night. Rates remain high in the following days, but we detect a sharp reversal after the 21st in line with the closing of the first weekend. Another peak is noticeable on Friday, May 27th, for the official festival closing.

The most prominent change in rates is recorded on May 22nd where the maximum price summits to €1,250.

(Information Source: PredictHQ)

And Action! Tourism & Territory KPIs

The Covid Safety Index, our proprietary indicator measuring the effectiveness of anti-Covid actions taken by businesses and operators in Cannes and the trust and perception expressed by visitors, has been stable since January 2022 at 58.3/100.

This is a good score and on point with nearby tourism destinations. Italy recorded 55.1/100 in the same time period, a significant increase compared to the same period in 2021 (36/100).

This result demonstrates how measures taken by public and private organizations, together with the vaccination campaign, have made people more willing and confident to travel again. Moreover, since March 14th, the use of facemasks is no longer compulsory throughout France, boosting the country’s perception relating to safety and security.

Even the Sentiment Score, the index that measures the level of overall customer and visitor satisfaction, recorded an excellent result of 84.9/100.

Location Intelligence: Understanding trends and behaviors with territorial analysis

By leveraging our Location Intelligence solutions, we took an in-depth look at Cannes to evaluate how businesses and local operators are perceived by visitors.

Location Intelligence (LI) refers to the methodology of deriving insights from points of interest and ‘places’ data to answer spatial questions, such as:

- Which areas are most popular overall and which are most frequented by my target audience? When is foot traffic the highest and lowest?

- Where should I place outdoor media and advertising for my products?

- Which venues, distributors and territories should I focus on for site selection?

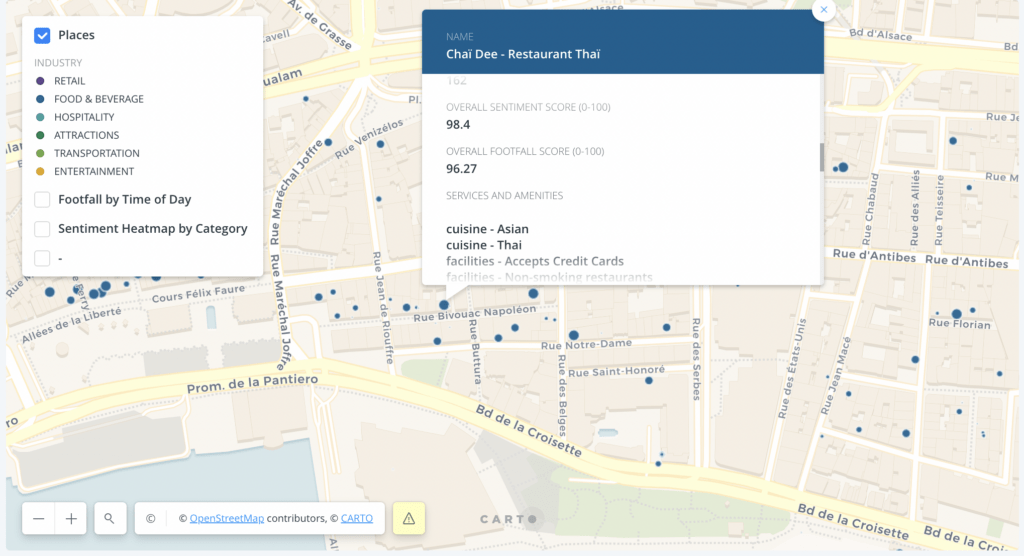

We’ve mapped all the tourism-related businesses in the heart of Cannes and made them viewable on an interactive map that includes 1,135 POIs (Points of Interest) across six categories (restaurant, hotel, retail, etc.) and 160 subcategories (bars, restaurants, women’s clothing stores, jewelers, etc.).

Thanks to the Time Machine, it’s possible to view the data according to a specific time period of interest – in this case we’re evaluating the data from January 2021 to present day.

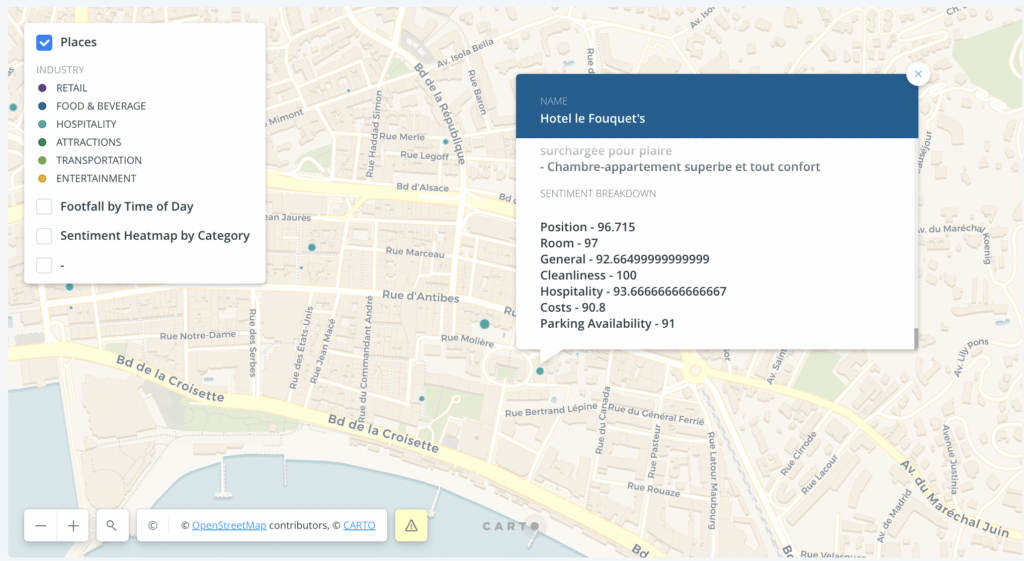

With the map, we have filtered the POIs to see the difference between weekend and weekday foot traffic. Additionally, all business can be filtered Sentiment – that is, the reputation of any POI or territory in the eyes of customers. For each Point of Interest, we have access to an extensive list of information, from opening hours to review extracts and snippets.

Star-studded Aperitivo: Where do the celebrities meet?

When evaluating the data from the summer of 2021, the period in which the previous edition of the Film Festival was held, the areas of Cannes that record the highest Popularity Index (77.47) in the afternoon hours (3pm-6pm and 6pm-8pm) are located in the west of the city.

The Popularity Index is our in-house KPI to measure the pedestrian flow of any point of interest in the area overall and broken down by time of day to pinpoint peak and off-peak times.

From our analysis, the bars and cafes in Cannes with the highest Sentiment are mostly located in areas with higher Popularity Index:

- Chez Margaux – Sentiment 98.45/100; Popularity 77

- Dandy Club Cannes – Sentiment 98; Popularity 80.9

- Val’my Bistro – Sentiment 94.30; Popularity 79.9

- L’Experience – Sentiment 94; Popularity 92

Palme d’Or-Worthy Hotels: Where to stay in Cannes for the Film Festival

Across hospitality and accommodation properties, we tracked down which 4 and 5-star hotels are the most popular in the summer season.

Best 4 star hotels:

- Hotel le Fouquet’s – Sentiment Score 95.57

- Hôtel Club Maintenon – Sentiment Score 95.5

- Hotel Victoria – Sentiment Score 91.71

Best 5 star hotels:

- Five Seas Hotel – Sentiment Score 87.85

- Hôtel Martinez – In the Unbound Collection by Hyatt – Sentiment Score 86.3

- Hotel Barrière Le Majestic Cannes – Sentiment Score 86

Shopping: The Most Popular Boutiques in Cannes

During the duration of the Film Festival, the foot traffic peaked across retail shops and boutiques.

Our analysis shows that these are the most popular and appreciated stores in the star-studded French destination:

- TPGK -Cannes Boutique – Clothing – Sentiment Score 99.2/100; Popularity Index 90.1

- Le Temps des Cerises – Clothing – Sentiment Score 98.2; Popularity Index 92.4

- FRED CANNES – Jewelry – Sentiment Score 97.7; Popularity Index 72.8

- Linvosges – Decoration and Furnishings – Sentiment Score 97.7; Popularity Index 72.8

Ethnic Food is Winning the Hearts Across Cannes

To our surprise, when it comes to food, the highest ranking of the restaurants with the best reputation in town is composed of non-French restaurants.

- Boxing Day – Fusion restaurant – Sentiment Score 98.7

- Chaï Dee – Thaï cuisine – Sentiment Score 98.4

- Ibiza Tapas – Spanish cuisine – Sentiment Score 97.78

- Quintazul – Portuguese cuisine – Sentiment Score 97.5

Location Intelligence, Events & Territory Analysis: Drive your strategies with data

At Data Appeal we conduct hyper-granular spatial analyses by leveraging our large data lake which brings together both quantitative (address, category, services provided) and qualitative (sentiment, popularity, popularity) data, related to any type of point of interest across hundreds of categories – from shops, hotels and restaurants to transportation, banks and attractions. The insights we derive benefit a variety of use cases including:

- Brand/Business Evaluation and Performance

- Destination & Competitor Analysis

- Site/Distributor Selection

- Outdoor Media & Advertising

In the case of Cannes, this analysis could support a DMO (destination marketing organization) or tourism board to understand which are the most popular and frequented areas and businesses of Cannes, their perceived quality (Sentiment) and where certain services are located and where they’re lacking.

For a media or advertising agency, a location intelligence map is invaluable when launching Outdoor Advertising campaigns. It’s an accurate and comprehensive reference point to identify the most strategic places to place billboards, transit ads or digital signage.

Companies in the retail sector – such as clothing, jewelry, furniture – incorporate location intelligence maps to identify areas with the highest growth potential. Knowing where to open new stores is critical to invest strategically and outperform competitors.

Meanwhile, for Consumer Goods brands, having a market evaluation tool is imperative for site selection and qualification to expand the sales network and improve brand positioning.

It’s no wonder that more and more brands around the globe are choosing Location Intelligence to make strategic decisions and investments.

Want to know if Location Intelligence can support your business to make more data-driven decisions and investments?

Contact us for a free, no obligation demo.

Immagine di copertina – Credits Gil Zetbase

Gil Zetbase, CC BY-SA 4.0 , via Wikimedia Commons